A 2025 Technical Deep-Dive into Present & Future Power-trains

Abstract

Forklifts are no longer “one-fuel-fits-all” machines. In 2025 the global fleet is powered by five distinct energy families—lead-acid, lithium-ion, hydrogen fuel cells, internal-combustion liquids (diesel, gasoline) and gaseous hydrocarbons (LPG, CNG)—each with unique energy chains, conversion efficiencies and environmental signatures. This article reviews the physics, engineering and economics of every option, quantifies real-world efficiencies, and projects the next decade of hybridisation, battery chemistries and green-hydrogen pathways.

Introduction: why the question matters

Material-handling equipment consumes roughly 2 % of all industrial energy worldwide. Yet forklifts operate in close proximity to people, food and precision machinery, so the choice of energy source directly affects indoor air quality, noise, carbon accounting and total cost of ownership (TCO). Regulatory drivers—EU Stage V, EPA Tier 4 final, China’s non-road VI, California’s 2026 zero-emission yard-truck mandate—are accelerating the transition away from unabated fossil fuels. Understanding the technical nuances of each power source is therefore essential for fleet managers, OEM engineers and policy makers alike.

Taxonomy of forklift power sources (2025)

|

Category |

Energy vector |

Prime mover |

Typical rating |

Market share (global) |

|

Electric 1 |

48–80 V lead-acid battery |

DC/AC motor |

2.5–10 kWh |

38 % |

|

Electric 2 |

Li-ion NMC/LFP pack |

AC PM / induction |

10–50 kWh |

27 % |

|

Electric 3 |

Hydrogen PEM fuel cell |

BLDC motor |

5–15 kW stack |

2 % |

|

IC liquid |

Diesel / HVO |

Compression ignition |

30–55 kW |

16 % |

|

IC gaseous |

LPG / CNG |

Spark ignition |

25–50 kW |

17 % |

Electric forklifts: battery-centric architectures

3.1 Lead-acid: the incumbent work-horse

Flooded lead-acid traction batteries remain the default indoors up to 5 t capacity. A 48 V, 625 Ah pack stores 30 kWh gross; 80 % depth-of-discharge (DoD) gives 24 kWh usable—enough for 5–6 h of continuous counterbalance duty . Round-trip efficiency (charger → battery → motor → wheels) is 72 %; charger η = 92 %, battery coulombic η = 90 %, motor & inverter η = 93 %, gearbox 95 %. Energy losses manifest as heat inside the battery room, necessitating 4–6 air changes per hour. Maintenance includes weekly equalisation charges and water top-up; lifetime is 1,500 cycles at 80 % DoD. Recyclability is excellent—99 % of Pb is recovered—yet incremental energy density (35 Wh kg⁻¹) cannot satisfy multi-shift operations without battery swapping.

3.2 Lithium-ion: fast-charge enabler

Li-ion packs (LFP or NMC) deliver 150–180 Wh kg⁻¹, triple the volumetric density and accept 1–2 C charge rates. Opportunity-charging during 15 min coffee breaks eliminates battery rooms: a 25 kWh LFP pack recovers 6 kWh (≈ 25 % SOC) in 12 min with a 400 A, 80 V charger . Calendar life reaches 4,000 cycles at 80 % retained capacity, translating into 10–12 years in single-shift warehousing. Well-to-wheel (WTW) GHG emissions fall by 30–50 % versus lead-acid when charged with the 2025 EU grid (0.24 kg CO₂ kWh⁻¹) . Capital premium is 1.8× lead-acid, but TCO converges after 18 months in two-shift applications because energy cost per pallet moved drops 35 %.

3.3 Hydrogen fuel-cell: the zero-emission ICE analog

PEM fuel-cell forklifts replace the battery with a 5–10 kW stack plus 1–2 kg of 35 MPa H₂. Refuelling takes 2–3 min, making the technology attractive for 24/7 cold-store or cross-dock sites. System efficiency (HV DC output) is 48 % at 25 % rated power; DC–bus feeds a 750 V inverter and PM motor. WTW analysis shows 2.3 kg CO₂ kg⁻¹ H₂ when H₂ is produced from SMR-natural gas, falling to 0.7 kg when 50 % renewable electricity is used . Fuel-cell durability exceeds 15,000 h; however, infrastructure capex (compressor, storage, dispenser) is 0.8–1.2 M€ per site, limiting adoption to fleets > 60 units.

Internal-combustion engines: liquid fuels

4.1 Diesel: power density for heavy outdoor duty

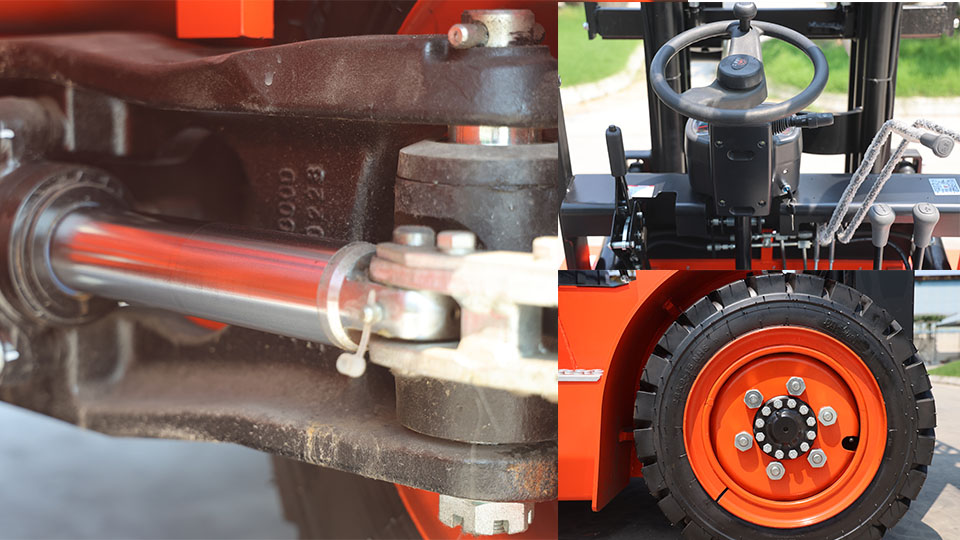

The 3.5–5 t CPC(D)35M class discussed earlier uses a 39 kW Quanchai diesel meeting China VI. BSFC is 240 g kWh⁻¹ at rated speed; thermal efficiency 32 % [user data]. Diesel forklifts excel on gradients (20 % laden) and in scrap-yards where dust would foul fuel-cell filters. Exhaust after-treatment includes DOC + SCR + DPF, adding 120 kg and €2,800 cost. PM emissions are 0.015 g kWh⁻¹; NOx 0.4 g kWh⁻¹. WTW CO₂ is 3.2 kg per litre of diesel, or 0.76 kg kWh⁻¹ mechanical output—five-fold higher than EU-grid-charged Li-ion .

4.2 Renewable drop-ins: HVO & B100

Hydrotreated vegetable oil (HVO) is a paraffinic diesel substitute with 90 % lower fossil-CO₂ and identical cetane. OEMs such as Volvo and Cat have cleared engines for 100 % HVO without hardware changes. Energy density is 34 MJ litre⁻¹ (7 % lower than ULSD), so fuel autonomy drops 5–7 %. Cold-flow improvers allow −30 °C operation, critical in Nordic ports. Price spread vs ULSD narrowed to +0.12 € litre⁻¹ in 2025 thanks to EU RED-II credits.

Internal-combustion engines: gaseous fuels

5.1 LPG (propane/butane)

LPG forklifts dominate 2–3 t indoor/outdoor mixed fleets in North America (65 % share). A 33 kW Kubota spark-ignition engine runs on 95 % propane, 5 % butane. BSFC is 1.45 kg kWh; vaporiser pressure 0.4 MPa. CO emissions are 90 % lower than gasoline; THC + NOx 1.2 g kWh⁻¹. WTW GHG advantage over diesel is 18 %, but indoor CO risk mandates 50 ppm alarms . Fuel is stored in exchangeable 33 kg steel cylinders; each cylinder yields 6.5 h runtime on a 2.5 t truck.

5.2 CNG & bio-methane

Compressed natural gas (200 bar) offers 20 % CO₂ reduction versus diesel. Bio-methane from anaerobic digestion is carbon-negative (−45 g CO₂ MJ⁻¹) and qualifies for UK RTFO certificates. Storage volume is the barrier: nine Type-IV composite cylinders (200 l water volume) are required to match the autonomy of 80 l diesel.

Comparative energy efficiency

Using the same duty cycle—1 t payload, 100 m horizontal, 3 m lift, 20 cycles h⁻¹, 8 h shift—we obtain:

|

Power source |

kWh consumed per shift |

WTW CO₂ kg per shift |

Direct OPEX (EU energy prices) |

|

Li-ion (EU grid) |

28 |

6.7 |

€6.2 |

|

Lead-acid (EU grid) |

34 |

8.2 |

€7.5 |

|

H₂ (50 % wind) |

45 (LH2) |

10 |

€18 |

|

Diesel (ULSD) |

64 |

51 |

€25 |

|

LPG |

58 |

43 |

€22 |

Li-ion uses 56 % less energy at the wheel than diesel because:

Electric motor η = 93 % vs diesel η = 32 %

Regenerative braking recovers 8–15 % of lift-lowering energy

No idle losses—electric drive stalls at zero torque.

Emerging architectures

7.1 Battery–fuel-cell hybrid

Nissan and Hyster have prototyped a 10 t reach-stacker combining a 30 kWh LFP buffer with a 20 kW fuel-cell range extender. The battery supplies peak power (100 kW) for lifting; the stack recharges during idle. Result: 50 % smaller hydrogen storage (3 kg vs 6 kg) and 35 % lower fuel-cell duty cycle, cutting system cost 18 %.

7.2 Solid-state batteries

Toyota’s sulfide solid-state pilot line (2025) targets 400 Wh kg⁻¹ and 10-min fast-charge to 80 %. Thermal runaway onset rises to 220 °C, permitting 2 C continuous charge without cooling plates. Forklift packs would shrink 30 %, enabling 12 t capacity sit-down trucks to adopt electric power for the first time.

7.3 Synthetic e-fuels for legacy fleets

Power-to-Liquid (PtL) e-diesel (Sunfire, 2026) offers 88 % WTW CO₂ reduction. At 1.8 € litre⁻¹ it is 3× ULSD, but carbon contracts-for-difference (CCfD) could close the gap for captive fleets unable to electrify (e.g., 45 t container handlers).

Total cost of ownership (2025 EU case study)

Assumptions: 2.5 t capacity, 2,000 h year⁻¹, 5-year life, 7 % discount rate, energy prices: electricity 0.18 € kWh⁻¹ (industrial), diesel 1.35 € l⁻¹, LPG 0.92 € l⁻¹, H₂ 9 € kg⁻¹.

|

Metric |

Li-ion |

Lead-acid |

Diesel |

LPG |

Fuel-cell |

|

Purchase price (€) |

38,000 |

30,000 |

28,500 |

27,000 |

55,000 |

|

Energy & fuel (5 y) |

6,200 |

7,500 |

25,000 |

22,000 |

45,000 |

|

Maintenance (5 y) |

4,500 |

7,000 |

12,000 |

10,500 |

8,000 |

|

Residual value |

−14,000 |

−9,000 |

−8,000 |

−7,500 |

−18,000 |

|

Net present cost |

34,700 |

35,500 |

57,500 |

52,000 |

90,000 |

Li-ion achieves the lowest TCO despite the highest up-front cost; fuel-cell remains 2.6× Li-ion owing to hydrogen price and infrastructure depreciation.

Environmental life-cycle assessment

A cradle-to-grave study (ISO 14040) of 2.5 t electric trucks shows that 68 % of life-cycle GHG is electricity use, 14 % battery manufacture, 8 % steel chassis, 5 % motor copper, 5 % end-of-life . Switching to 100 % renewable electricity cuts total CO₂-eq from 38 t to 12 t over 10,000 h. Li-ion chemistry shift from NMC-111 to LFP reduces battery embodied CO₂ by 18 % and eliminates cobalt supply-chain risks.

Safety & regulatory considerations

Li-ion: thermal runaway > 150 °C; requires EN 1175-compliant battery management system (BMS) with redundant temperature, voltage, current monitoring; sprinkler density 12 mm min⁻¹.

H₂: NFPA 2 mandates 1 % H₂ detection, emergency venting within 30 s, 5 m separation from cylinders.

LPG: OSHA 1910.178 limits indoor CO to 50 ppm; catalytic converters mandatory from 2026 in EU.

Diesel: Stage V particulate limit 0.015 g kWh⁻¹; requires DPF active regeneration inhibit switch when parked indoors.

Decision matrix: how to choose in 2025

|

Operational parameter |

Recommended power source |

|

Single-shift, indoor food warehouse |

Li-ion |

|

Multi-shift, -25 °C cold store |

Fuel-cell |

|

Rough yard, 20 % gradients |

Diesel (HVO capable) |

|

Rental fleet, variable site |

LPG dual-fuel |

|

Explosive-zone ATEX |

Lead-acid (aircraft industry) |

Future outlook (2026-2035)

Battery price curve: Li-ion pack cost falls below 90 $ kWh⁻¹ by 2028, making 8 t electric counterbalance cheaper than diesel on sticker price.

Green hydrogen: EU CfD support reduces delivered H₂ to 5 € kg⁻¹ in ports by 2030, unlocking 50 % fuel-cell share in > 60 unit fleets.

Solid-state ramp-up: Toyota, LG, CATL commission GWh-scale lines; first forklift packs 2028.

Hybridisation: super-capacitor + Li-ion micro-hybrid for high-lift order pickers recovers 25 % of lowering energy, cutting battery size 15 %.

Circular economy: EU Battery Regulation (2027) requires 65 % Li recycling efficiency; closed-loop remanufacturing adds 3,000 € residual value per pack.

Conclusion

The forklift industry has become a microcosm of the global energy transition. Batteries dominate indoor applications and will extend into outdoor heavy lifting as solid-state chemistry matures. Hydrogen offers a pragmatic zero-emission route for continuous, cold or high-power duty, while renewable drop-in fuels decarbonise legacy IC assets. The optimum choice is no longer a single technology but a site-specific optimisation of energy vectors, duty cycles and carbon prices. Managers who treat the forklift fleet as an extension of the factory energy system—and not as isolated trucks—will capture the lowest TCO and the fastest route to net-zero logistics.

Name: selena

Mobile:+86-13176910558

Tel:+86-0535-2090977

Whatsapp:8613181602336

Email:vip@mingyuforklift.com

Add:Xiaqiu Town, Laizhou, Yantai City, Shandong Province, China